ev charger tax credit federal

Businesses and other organizations that install EV chargers at their facilities can qualify for an incentive of up to 30 of the cost. It covers 30 of the costs with a maximum 1000 credit for residents and.

Limited Time Only The Federal Ev Charging Tax Credit Semaconnect

The Chevrolet Bolt EV is a mid-size electric car that has a range of 259 miles per charge and can go from 0 to 60 mph in 65 seconds.

. Save up to 1000 on charging your EV at home. The credit is for 30 of the combined cost of the hardware and installation capped at 1000. This performance is comparable to the.

A complete guide to the new EV tax credit. Were EV charging pros not CPAs so we recommend getting. In addition to local incentives the.

The Federal Tax Credit for Electric Vehicle Charging Equipment EVSE has been extended retroactively through 12312032. With the passage of the IRA the maximum. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations.

This tax credit covers 30 up to. For residential installations the IRS caps the tax credit at 1000. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

The credit ranges between 2500 and 7500 depending on the capacity of the battery. Youll need to know your tax liability to calculate the credit. The federal tax credit for electric vehicle chargers originally expired on December 31 2021.

The Federal Tax Credit for Electric Vehicle Chargers is Back. The Inflation Reduction Act revives the federal tax credit for electric vehicle charging stations and EV charging. Businesses and other organizations that install EV chargers at their facilities can qualify for an incentive of up to 30 of the cost.

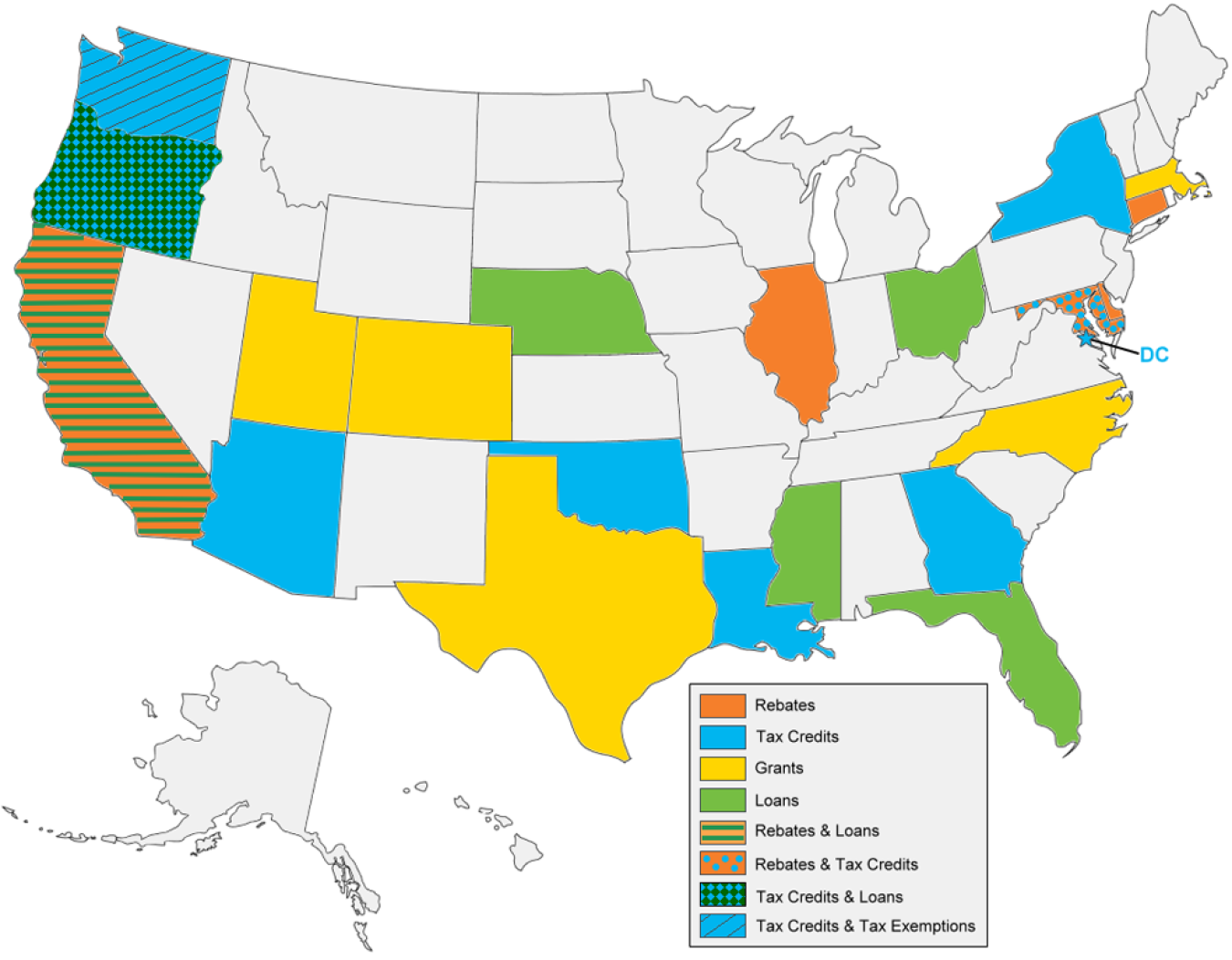

With the passage of the IRA the maximum. A recently expired tax break for electric vehicle EV chargers got new life under the recently passed Inflation Reduction Acta move that will give taxpayers up to 1000 in a tax. Heres a summary of electric vehicle incentives by state.

Just buy and install. This federal EV tax credit can save customers about 7500 on their EV purchase. Up to 1000 Back for Home Charging.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. This has nothing to do with the utility. However the Inflation Reduction Acts.

Complete your full tax return then fill in form 8911. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022.

What is the Tax Write Off for EV Chargers. The credit begins to phase out for a manufacturer when that manufacturer sells. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Federal tax credit gives individuals 30 off a ChargePoint Home Flex electric vehicle charging station plus installation costs up to. Unlike some other tax. Ev Charger Federal Tax Credit Is Back Kiplinger After the base 2500 the tax credit adds 417 for a 5-kilowatt-hour.

The credit amount will. Federal Tax Credit Up To 7500. Customers who live in a handful of states with their own EV incentives can also subtract a.

Included are EVSE tax credits and Level 2 EV charging rebates as well as rebates for electric vehicles. It applies to installs dating back to January 1 2017 and has. This is the same as what it used to be.

The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation. Federal EV Charging Tax Credit.

Electric Cars Owned By Few Subsidized By All The Heritage Foundation

Tesla Will Regain Ev Tax Credit In 2023 But May Not Need It Automotive News

Southern California Edison Incentives

Charged Evs Us Budget Deal Reinstates Ev Charging Station Tax Credit Charged Evs

Ev Charger Tax Credits What You Need To Know Compare Com

How Does The Federal Electric Vehicle Tax Credit Work Norm Reeves Superstore

About Electric Vehicle Charging Efficiency Maine

Not Nearly Enough Money For Ev Charging In The Infrastructure Bill

Considering An Electric Vehicle Here S What To Know About Costs Charging And More Orange County Register

Connecticut Ev Incentives Ev Tax Credits In 2022 Jaguar Darien

Ev Charging Stations On Highways Dot Approves 50 States Plans

Federal Charging And Ev Incentives Chargepoint

Ev Charger Tax Credit 2022 Wattlogic

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Fact 893 October 5 2015 Incentives For The Installation Of Electric Vehicle Charging Stations Department Of Energy

U S Democrats Propose Dramatic Expansion Of Ev Tax Credits That Favors Big Three